Condominium markets — particularly in South Florida — operate very differently from single-family housing.

Two residences in the same tower can share identical square footage and floor plans, yet trade in distinctly different pricing environments. Exposure, elevation, line positioning, and renovation quality frequently create meaningful separation in value.

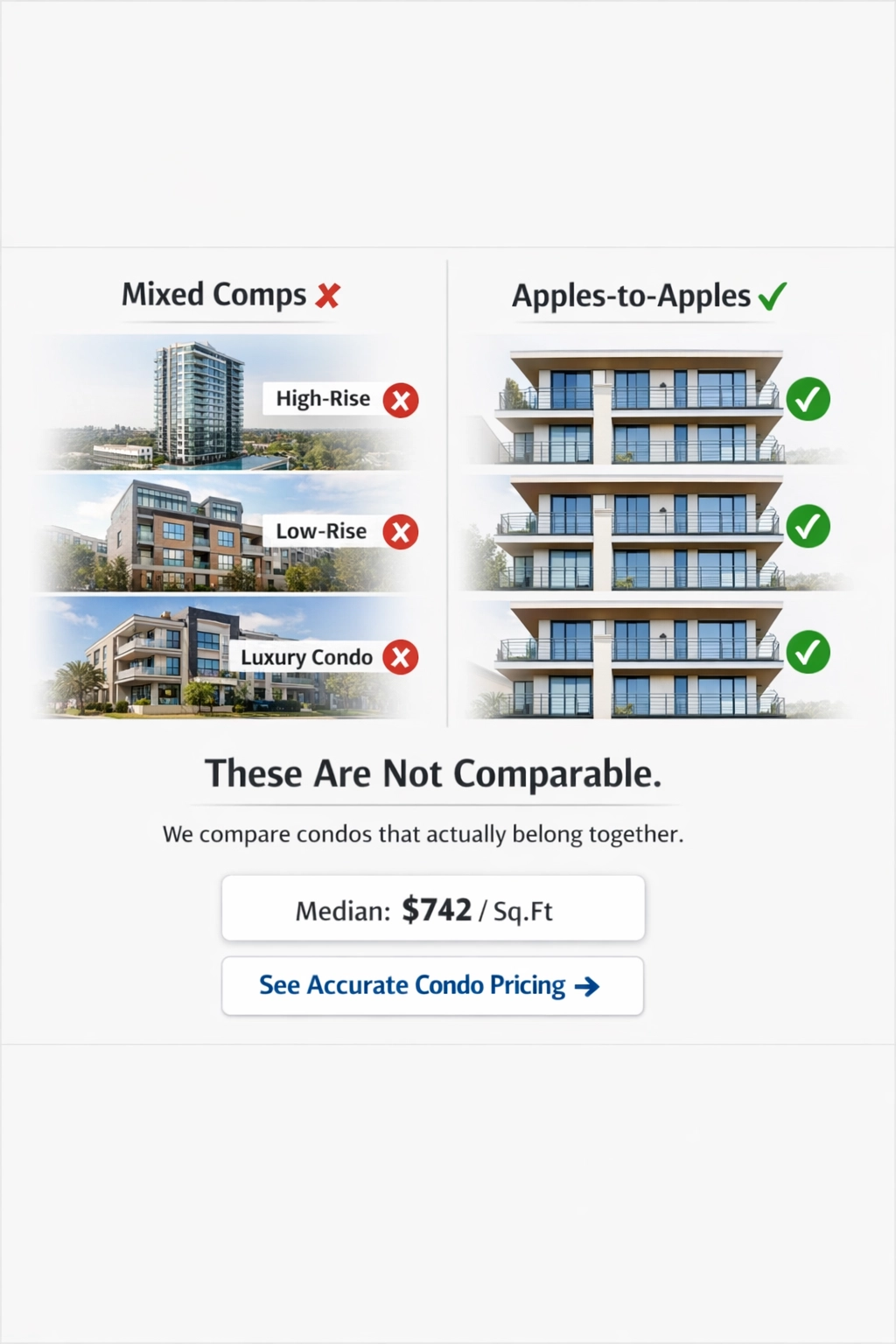

When search tools treat an entire building as one uniform market, that separation becomes blurred. Buyers are left comparing units that are not direct substitutes. The result is confusion, mispricing, and prolonged decision cycles.

A structured, building-level analytical framework addresses this problem directly.

Why Traditional Search Workflows Create Distortion

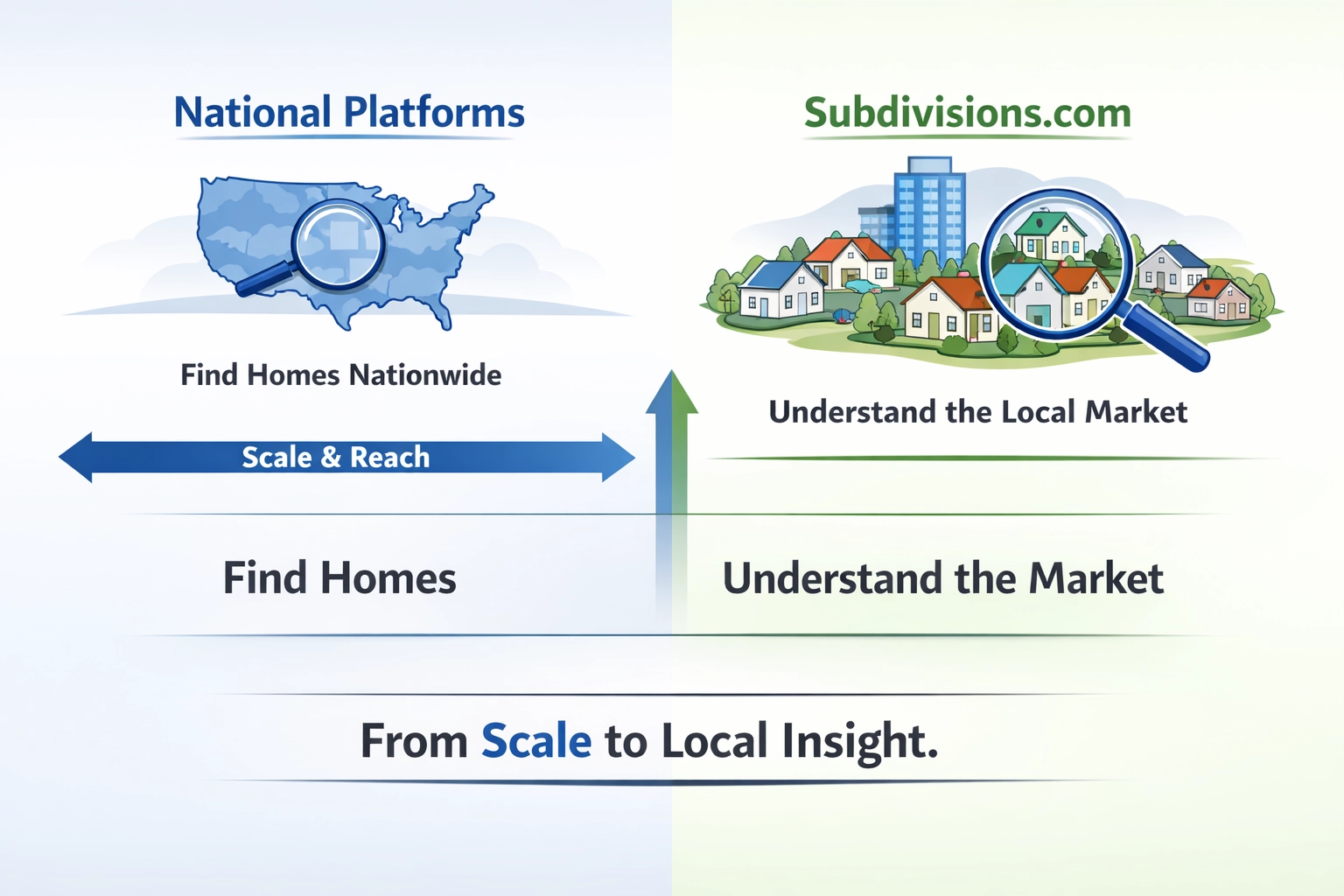

Most real estate platforms are optimized for inventory discovery. They group listings by city, price band, and general property type. That approach works for broad exploration but becomes inefficient in high-rise environments.

In a tower with multiple exposure tiers, the competitive set is not defined by the address alone. It is defined by the subset of units that buyers perceive as interchangeable.

For example:

Direct ocean-facing lines compete primarily with other direct ocean-facing lines.

High-floor units often trade in a different band than mid-floor tiers.

Recently renovated residences command separation from original-condition inventory.

Blended building averages conceal these distinctions. When buyers anchor to a single building-wide metric, they risk misjudging relative value.

Defining the True Competitive Set

Effective condo analysis begins by identifying the units that a buyer would realistically evaluate side by side.

This requires isolating:

Exposure direction

Floor band

Stack alignment

Recent transaction depth within that tier

When those variables are structured properly, pricing dispersion becomes interpretable rather than confusing.

In many South Florida towers, 20–30% dispersion within a building is normal. That range does not signal instability; it reflects structural segmentation.

Without segmentation, wide dispersion appears inconsistent. With segmentation, it becomes coherent.

Impact on Buyer Decision-Making

A structured micro-market view changes behavior in measurable ways.

First, it improves price anchoring. Buyers evaluate value against appropriate comparables rather than against blended metrics.

Second, it reduces cognitive overload. Instead of scanning dozens of loosely related listings, the focus narrows to relevant competition.

Third, it increases appraisal defensibility. Appraisers rely on comparable transactions within similar tiers. When the competitive set is properly defined, valuation support strengthens.

Finally, it shortens decision cycles. Clarity around positioning reduces hesitation and unnecessary renegotiation.

Thin Markets Require Discipline

Luxury condo buildings often experience limited turnover. In some properties, annual sales volume may be minimal.

In these environments, it is essential to distinguish between:

A structured range supported by multiple transactions

A baseline derived from limited activity

Insufficient recent data

Artificial smoothing in thin markets introduces risk. Transparent signal assessment, by contrast, improves confidence and protects pricing integrity.

From Browsing to Evaluation

The difference between broad search and structured analysis is not cosmetic.

Broad search emphasizes volume.

Structured analysis emphasizes competition.

In high-rise environments where value is shaped by exposure and tier separation, clarity depends on understanding where a unit sits within its micro-market — not simply within its building.

When the competitive environment is defined correctly, pricing decisions become more defensible and negotiation outcomes more predictable.

In luxury condo markets, structure is not optional. It is foundational.

Comments