Why the Next Era of Search, Valuation, and Investment Begins at the Subdivision Level

For decades, real estate has been organized around blunt instruments — ZIP codes, neighborhoods, citywide trends. But the most important decisions in real estate don’t happen at the ZIP code level. They happen at the kitchen table.

When buyers ask, “Is this a good deal?”, or when sellers ask, “How should we price this home?”, they’re not comparing ZIP codes. They’re comparing units, views, floors, amenities, and communities.

And that’s where macro-market data breaks down.

Welcome to the rise of micro-markets — the next frontier of real estate intelligence.

🔍 What Exactly Is a Micro-Market?

A micro-market is the smallest consistent unit of identity in residential real estate: a subdivision, a condo tower, a gated enclave. Unlike neighborhoods or ZIPs — which are often arbitrary or inconsistent — subdivisions are:

Defined by clear borders

Consistent in construction and amenities

Governed by shared rules (HOAs, 55+ policies, etc.)

Recognized by name in daily conversation

They represent not just where people live, but how they live.

In short: Micro-markets are real estate’s atomic unit — the layer where context, comparability, and behavior align.

🧩 The Problem with Macro Data

Most major portals — Zillow, Redfin, Realtor.com — still operate at the macro level. Their data spans too wide and cuts too shallow:

$/SqFt across ZIP codes

Time-on-market trends by city

AVMs that ignore view, floor, or community nuance

These signals may be directionally useful — but they often obscure more than they reveal.

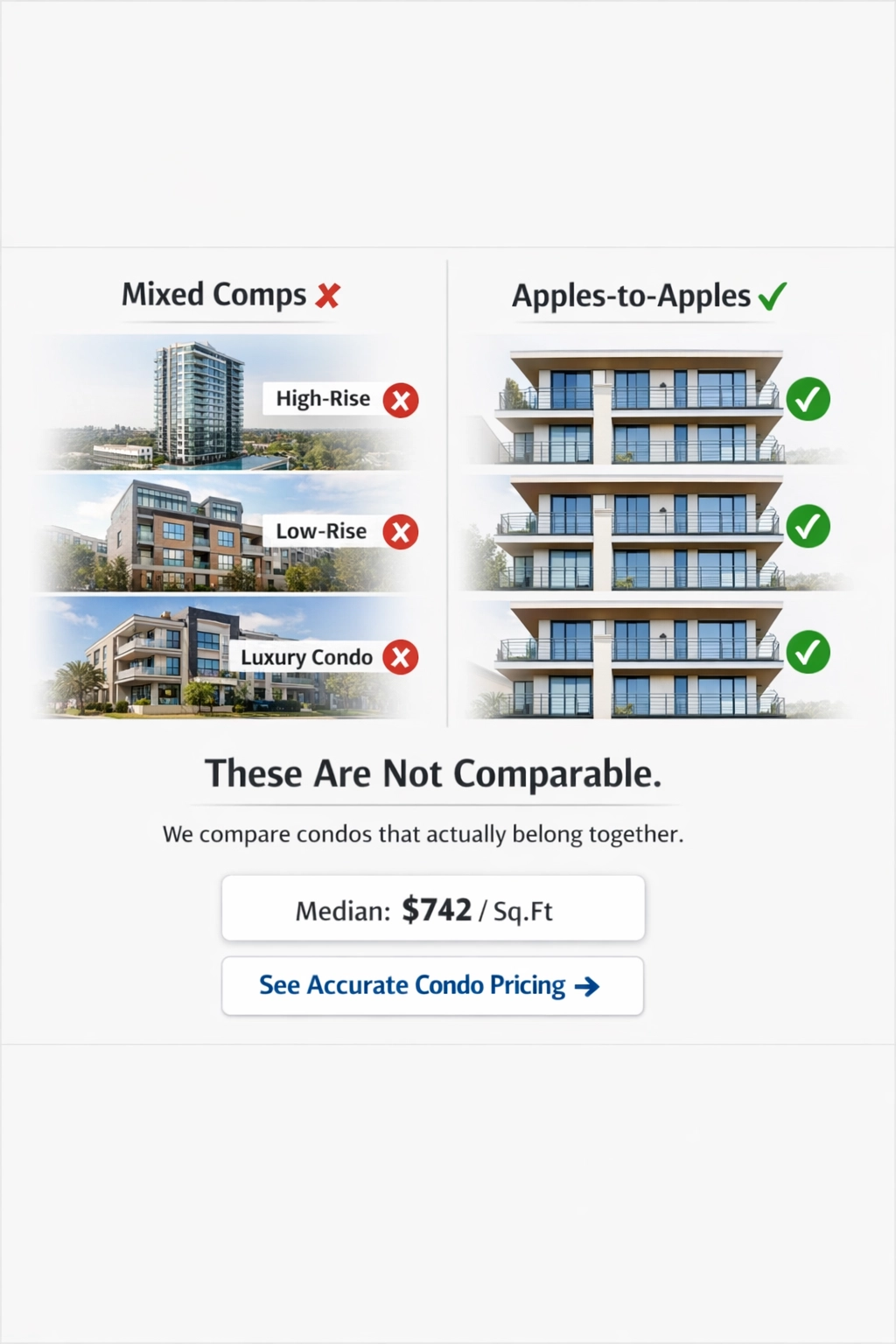

Imagine pricing a penthouse the same as a ground-floor unit in the same building.

Or comparing a 1980s townhouse in a gated subdivision with a new construction home across the highway.

Macro data assumes sameness. Reality doesn’t.

🚀 What Micro-Market Data Unlocks

Micro-markets don’t just make insights sharper — they make new insights possible.

Here’s what becomes visible when you operate at the subdivision level:

Previously Hidden | Now Unlocked with Micro-Market Data |

|---|---|

Randomized listing scrolls | Context-aware search by building/community |

Unreliable price-per-foot comparisons | Line-by-line, floor-by-floor pricing precision |

AVMs based on outdated, misaligned comps | Subdivision-tuned valuations with confidence scoring |

Missing lifestyle filters | Filter by 55+, pet-friendly, gated, amenities |

“Overpriced or underpriced?” = guesswork | Instant comps from same tower or lot line |

This isn’t just an upgrade in accuracy. It’s a new interface for the real estate market.

🧠 Intelligence at the Granular Level = Better Decisions

Real estate is emotional — but it’s also strategic. When buyers hesitate, sellers misprice, or agents fail to convert, it often stems from uncertainty.

Micro-market data removes that fog.

By structuring insights around how people already think — in terms of buildings, lines, views, and communities — we move from assumption to alignment.

That’s the foundation of Subdivisions.com.

🧱 The Missing Layer

At Subdivisions.com, we built what others don’t have:

A structured, verified, fully tagged subdivision layer — down to the community, HOA, and unit line.

It’s not scraped. It’s not inferred.

It’s handcrafted and quality-checked — built as infrastructure, not just interface.

Because without micro-markets, Search 2.0, AVM 2.0, and AI agents for real estate cannot function intelligently.

📍 Micro-location specificity

🏘️ Community-level context

📊 Actionable, trustworthy comparables

🤖 Infrastructure for AI-native valuation and search

💡 Who Benefits?

Consumers get clarity instead of confusion.

Agents win listings with smarter pricing.

Investors find hidden value and patterns.

Portals & AVM tools get precision inputs for next-gen AI applications.

🏁 The Bottom Line

Real estate’s biggest blind spot has been its coarseness.

We’ve made million-dollar decisions using ZIP code averages and 3-year-old comps.

But that era is ending.

The next generation of real estate tools — from search engines to valuation models to AI agents — requires data that understands how the market actually behaves.

And that starts with the Subdivision Layer.

Subdivisions.com isn’t just creating a new dataset. We’re building the foundation for Real Estate Search 2.0.

Structured. Local. Actionable.

Finally.

Comments