For more than two decades, real estate search has looked largely the same.

You type in a city or ZIP code.

You scroll through listings.

You compare prices, square footage, and photos.

And then — at the most important moment — you’re left to guess.

Is this price reasonable?

Is this unit actually comparable to the others?

Why do two homes that look similar have such different values?

What am I missing?

This uncertainty isn’t a failure of effort. It’s a limitation of how real estate search has been structured.

The problem with traditional real estate search

Most real estate platforms are designed for discovery, not decisions.

They’re very good at answering:

What’s available?

What’s new?

What fits my filters?

But they struggle to answer:

What is this home actually worth in its real market context?

How does this unit compare to truly similar properties?

Is this price aligned with what’s happening in this specific community?

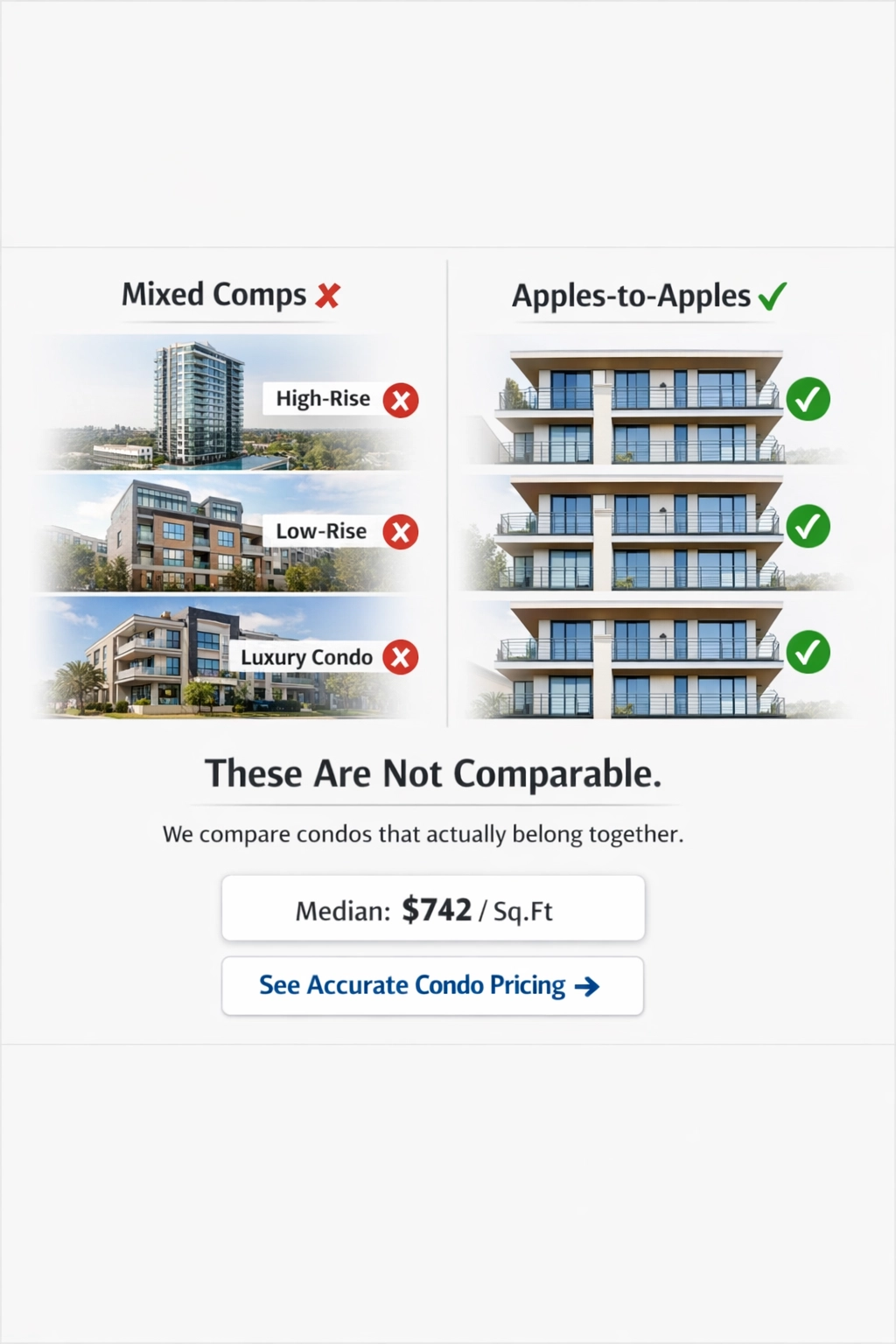

When search is organized broadly — by city, ZIP code, or radius — it mixes together homes that may look similar on paper but behave very differently in reality.

Different buildings.

Different communities.

Different buyer demand.

Different pricing dynamics.

The result is noise, not clarity.

Why guesswork still exists

Guesswork persists because most platforms flatten the market.

They treat homes as interchangeable points on a map, rather than parts of real, defined communities. But in practice, value is rarely set at the city or ZIP level.

It’s shaped at a much more granular level:

Within a subdivision

Within a condo building

Within a specific community with shared characteristics

That’s where pricing patterns form.

That’s where apples-to-apples comparisons actually exist.

Without that structure, even the most detailed listing data can still leave users uncertain.

What “less guesswork” actually means

Reducing guesswork doesn’t mean predicting the future or promising perfect prices.

It means giving people better context.

At Subdivisions.com, we focus on organizing real estate data around the communities where pricing decisions are actually made. That allows us to surface insights that are otherwise buried:

Comparable sales that are truly comparable

Pricing ranges grounded in real market activity

Trends that reflect how a specific subdivision or building behaves

Broader ZIP and city data shown as context, not substitutes

Instead of forcing users to assemble this manually — across listings, spreadsheets, and multiple tools — we structure it upfront.

The goal isn’t to tell anyone what to buy or sell.

The goal is to help them understand what they’re looking at.

From browsing to clarity

Most people don’t want more listings.

They want fewer blind spots.

Whether you’re a renter comparing units, a buyer deciding when to act, a homeowner trying to understand value, or an investor evaluating a market, confidence comes from clarity — not volume.

That clarity comes from:

Seeing like-for-like comparisons

Understanding how a specific community behaves

Knowing where a property fits within its true micro-market

That’s what “less guesswork” looks like in practice.

Comments