Modern real estate platforms surface volume.

Thousands of listings.

City-wide medians.

Building averages.

Broad price-per-square-foot summaries.

But in South Florida’s luxury condo market, clarity rarely comes from more listings.

It comes from structuring the right competitive set.

Inside One Building, There Are Multiple Markets

In high-rise environments across Miami, Fort Lauderdale, and Naples, pricing dispersion of 20–30% within the same building is common.

That dispersion is not random.

It reflects structural differences:

Exposure (direct ocean vs city view)

Stack alignment

Floor elevation

Layout tier

Renovation quality

For example:

In one Miami Beach tower, an 18th-floor east-facing unit recently traded at $1,250 per square foot, while a west-facing 8th-floor interior-tier unit sold near $980 per square foot.

Both shared the same address.

They did not share the same market.

When pricing is anchored to blended building averages, those distinctions disappear. And when distinctions disappear, noise increases.

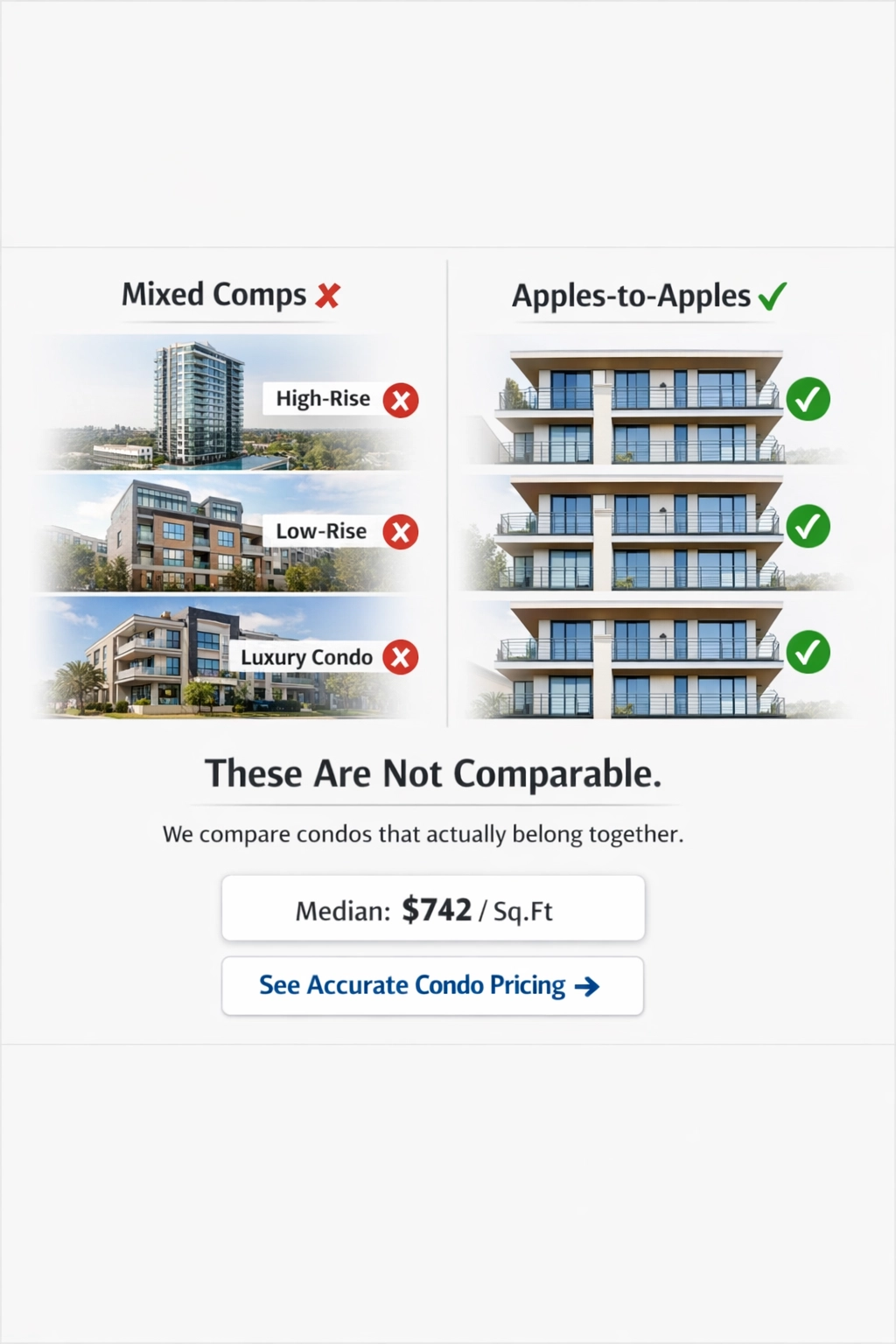

Signal vs. Noise in Condo Pricing

Noise in real estate pricing comes from irrelevant comparisons.

Common examples include:

Using interior-facing sales to price a direct ocean residence

Anchoring to a building-wide median instead of stack-level activity

Comparing renovated units to original-condition inventory

Blending high-floor and low-floor tiers without adjustment

These comparisons distort competitive positioning.

Subdivision-level structuring reduces this noise by isolating the true competitive set — the units a buyer would realistically compare side by side.

When irrelevant data is removed, pricing signal strength increases.

Why Subdivision-Level Anchoring Matters

Real estate competition rarely forms at the city level.

It forms within subdivisions and buildings.

The subdivision layer organizes listings and transaction history at the level where pricing pressure actually exists. It reveals:

Exposure-driven variance

Stack-level competition

Transaction depth within the building

Observed dispersion patterns

Wide dispersion inside a luxury building does not automatically indicate instability. In many South Florida towers, it reflects exposure tiers and structural positioning.

When pricing analysis respects those tiers, it aligns more closely with how buyers, agents, and appraisers interpret value.

See How Your Building Compares

Access subdivision-level market trends, observed pricing ranges, and signal strength for your building.

Why Signal Strength Matters in Thin Markets

Luxury condo buildings often experience limited turnover.

In some cases, there may be only one or two recorded sales in the past year.

In those situations, confidence in the underlying data becomes more important than producing a broad estimate.

Subdivision-level intelligence distinguishes between:

A structured pricing range supported by multiple transactions

A baseline anchored to a single observed sale

A limited range based on minimal activity

Insufficient recent transaction depth

Rather than smoothing over thin data, structured analysis communicates signal strength clearly.

That transparency reduces misplaced confidence and improves decision discipline.

What This Means for Condo Owners

Before positioning a property for sale, clarity around the competitive set matters.

Subdivision-level structuring helps:

Avoid anchoring to irrelevant comparables

Reduce pricing guesswork in low-turnover buildings

Improve appraisal defensibility

Strengthen negotiation leverage

Position confidently within the correct exposure tier

Pricing is not just about selecting a number. It is about understanding where your unit competes.

From Listing Volume to Structured Insight

More listings do not create better decisions.

Structure does.

By organizing data at the subdivision level, market noise decreases and competitive clarity improves.

When pricing reflects the true competitive environment — not blended averages — it becomes more defensible.

In high-rise markets where nuance defines value, clarity should precede commitment.

Know Your Competitive Set Before You Price

Subdivisions.com provides structured, subdivision-level pricing signals and market trends for South Florida condo owners.

$19/month — cancel anytime.

Comments