Why Subdivision-Level Market Intelligence Has to Start With Transaction Experience

Most real estate data platforms are built from dashboards.

Subdivisions.com was built from deals.

That distinction matters more than it sounds.

Because pricing in real estate doesn’t happen in spreadsheets.

It happens in negotiations.

In appraisal gaps.

In buyer hesitation.

In seller expectations.

In micro-market dynamics that never show up in city-wide averages.

When you’ve worked both sides of a transaction — buyers and sellers — you start to see where traditional market data falls short.

The Problem With Outside-In Pricing Tools

Many valuation tools are engineered from the outside looking in.

They aggregate:

City-wide averages

ZIP code medians

Blended building sales

Broad price-per-square-foot metrics

But they rarely account for what actually determines competition inside a deal.

In condo markets especially, two units in the same building can share an address — and still exist in completely different competitive tiers.

Exposure.

Stack.

Floor height.

View corridor.

Condition.

Those nuances don’t show up in simplified dashboards.

But they absolutely show up in negotiations.

What You Learn Working Inside Transactions

Working as a buyer agent teaches you:

Buyers anchor to comparable units, not building averages.

View and exposure differences justify significant price gaps.

Overpricing kills urgency quickly in thin micro-markets.

Appraisals rely on true competitive sets, not blended data.

Working with sellers teaches you:

Emotional pricing bias is common.

Thin sales history creates uncertainty.

One outlier sale can distort expectations.

Confidence in pricing matters as much as the number itself.

These insights don’t come from theory.

They come from watching deals stall — or close — in real time.

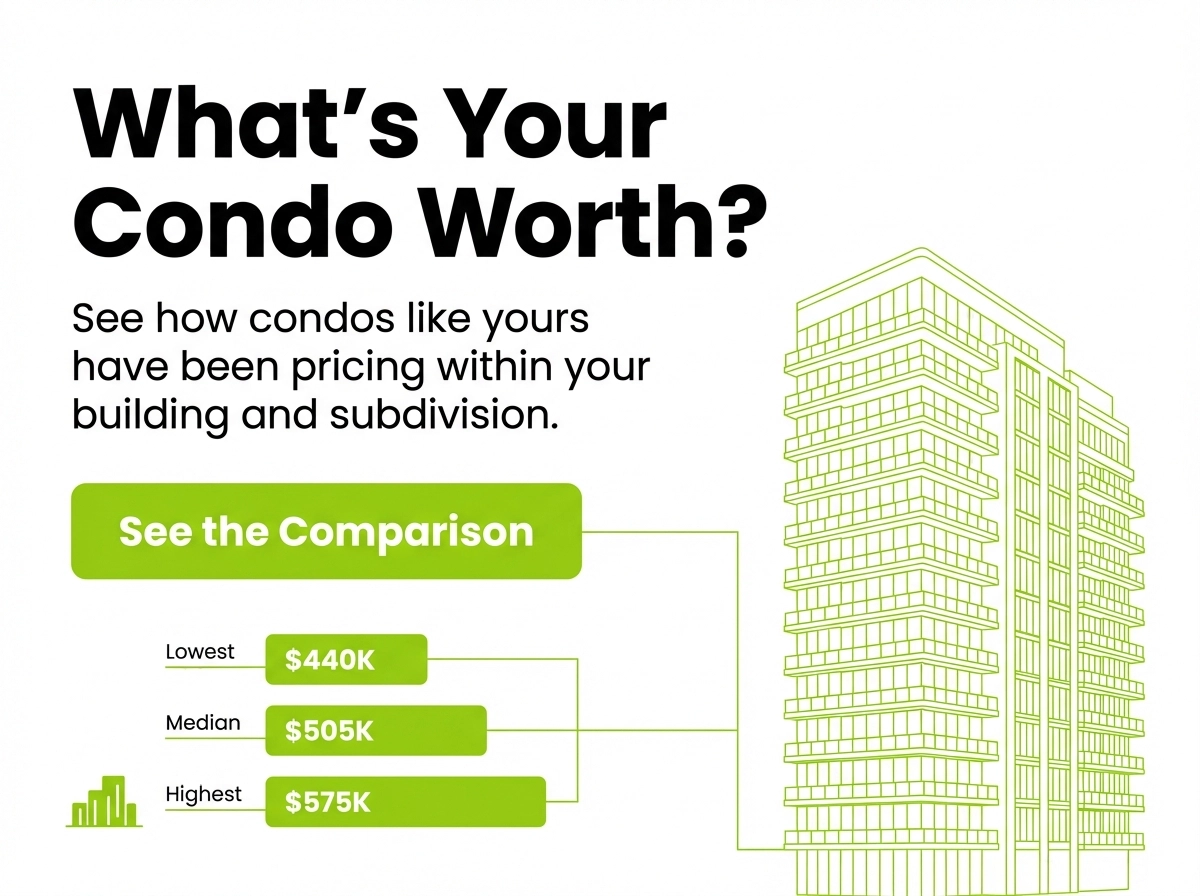

Why Thin Data Matters More Than Most Platforms Admit

In many condo buildings, especially luxury towers, 20–30% price dispersion is normal.

Ocean-facing stacks trade differently than city-facing ones.

Corner units behave differently than interior tiers.

High floors move differently than low floors.

If a pricing model blindly suppresses wide ranges, it misunderstands the building.

If it fabricates precision where there are only one or two sales, it misleads the user.

Real transaction experience teaches restraint.

Sometimes the most honest output is:

“Insufficient signal.”

That builds trust.

Subdivision-Anchored Micro-Market Intelligence

Subdivisions.com was built around a simple observation:

Inside one building, there are multiple markets.

Inside one subdivision, there are distinct competitive sets.

Pricing must reflect how competition actually functions — not how databases aggregate.

That’s why the platform:

Anchors analysis at the subdivision level

Works with observed $/SqFt dispersion

Degrades confidence intelligently when data is thin

Avoids artificial pricing ranges

Communicates signal strength transparently

This isn’t about building another estimator.

It’s about structuring micro-market clarity.

Precision Over Guessing

In real estate, false precision is dangerous.

A number that looks confident but lacks depth can cost:

Seller momentum

Buyer trust

Negotiation leverage

Appraisal stability

When data is thin, the responsible move isn’t to guess.

It’s to communicate signal strength.

That philosophy comes directly from transaction experience.

Built From Inside the Deal

Subdivisions.com wasn’t designed to look good in a pitch deck.

It was designed to reflect how pricing decisions actually happen — under real-world pressure.

Negotiation dynamics.

Competitive sets.

Exposure tiers.

Thin-market uncertainty.

Those realities shaped the product architecture.

Because when you’ve worked inside the deal, you design differently.

Clarity for High-Stakes Decisions

Real estate pricing is rarely casual.

For many condo owners, it’s one of the largest financial decisions they’ll make.

Clarity matters.

Confidence matters.

Transparency matters.

Subdivision-level intelligence isn’t just a data feature.

It’s a reflection of how transactions actually unfold.

And that’s what makes the difference.

Comments