For decades, real estate discovery has followed the same basic model: search listings, apply filters, compare prices, and hope the picture becomes clear.

That model worked when information was scarce.

Today, information is everywhere — yet clarity is not.

As AI enters real estate, many expect it to instantly solve pricing confusion, misaligned expectations, and inconsistent outcomes. But in practice, AI often produces answers that feel reasonable while still leaving buyers and sellers uncertain.

The problem isn’t that AI is weak.

The problem is that AI is missing context.

The Limits of Classified Search

Most real estate platforms — Zillow, Redfin, Homes, brokerage portals — are built on a classified search foundation. They organize homes as individual listings with attributes like price, size, and location.

This structure is excellent for:

finding available inventory

browsing options

comparing surface-level features

But it breaks down when people try to answer harder questions, such as:

Why did this condo sell faster than another?

Why do similar units in the same area trade at different prices?

What does “fair value” actually mean right now?

Search shows what’s available.

It doesn’t explain how the market behaves.

Why AI Struggles With Real Estate Decisions

AI systems are only as good as the structure of the data they’re given.

In real estate, most data is organized around:

listings

transactions

city or ZIP-level statistics

What’s missing is the layer where real decisions are made.

AI can summarize listings.

AI can calculate averages.

AI can surface trends.

But without understanding how buyers actually compare homes, those outputs lack grounding.

That’s why AI-generated pricing explanations often feel incomplete. They describe the market broadly, but they don’t explain outcomes locally.

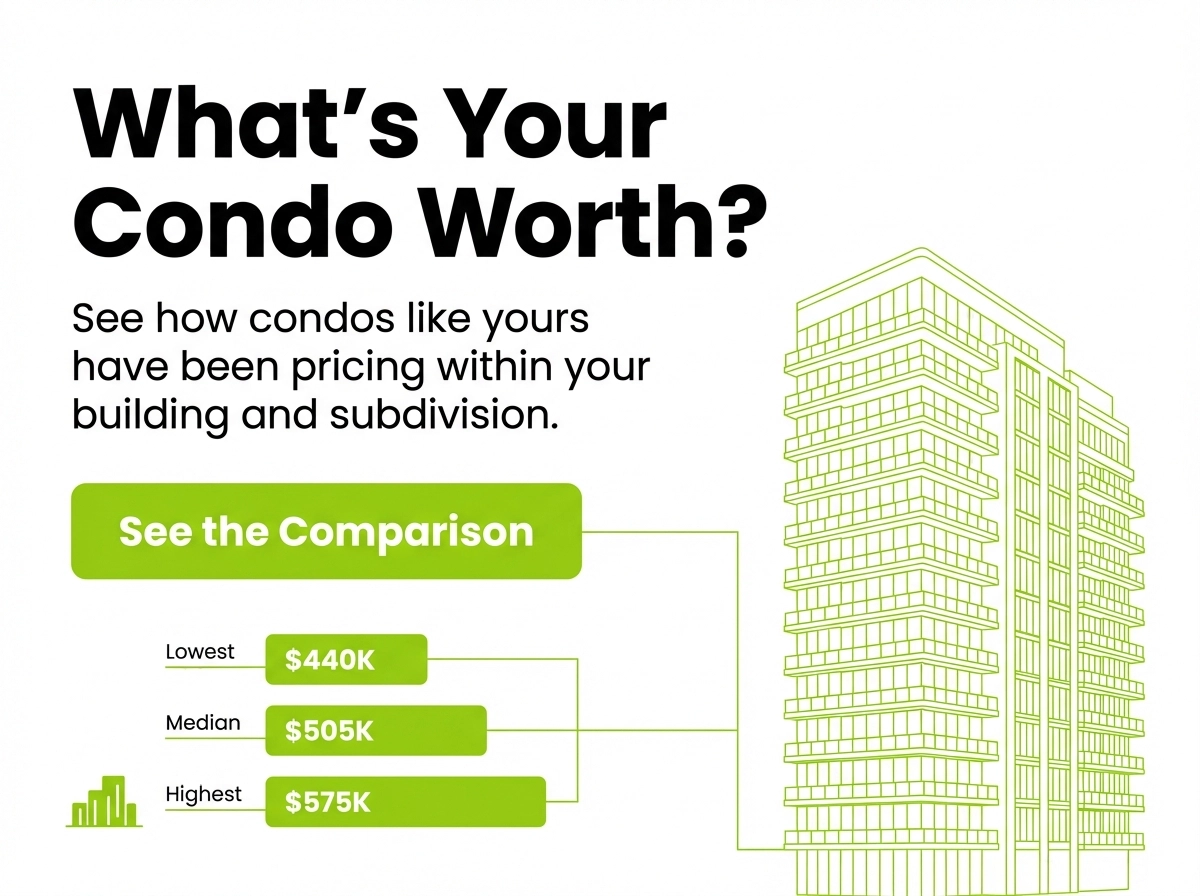

Where Decisions Actually Happen: Subdivisions and Buildings

In practice, buyers don’t compare every condo in a city.

They narrow quickly.

They compare:

units in the same building

similar floor plans

nearby subdivisions with comparable characteristics

This is where pricing behavior forms.

This is where competition exists.

This is where outcomes diverge.

A condo building isn’t just a collection of listings — it’s a micro-market with its own dynamics, buyer preferences, and pricing boundaries.

Without anchoring data to this level, AI lacks the ability to reason like a local expert.

Subdivision Context Is the Missing Layer

Subdivision-level structure gives meaning to raw data.

It allows AI to:

identify true apples-to-apples comparisons

understand which properties actually compete with each other

detect mispositioning instead of just mispricing

explain why outcomes differ, not just that they do

This context doesn’t replace agents, CMAs, or professional judgment. It strengthens them.

It creates a neutral starting point — one grounded in how the market actually behaves at a micro level.

From Search to Understanding

The next evolution of real estate platforms isn’t about more listings or faster filters.

It’s about moving from discovery to understanding.

Search answers:

“What’s out there?”

Subdivision context answers:

“What does this mean for my decision?”

AI becomes powerful in real estate not when it predicts prices, but when it can explain market behavior in context.

A Better Default for Real Estate Decisions

Real estate decisions are high-stakes and irreversible. People don’t need louder opinions — they need clearer framing.

Subdivision-anchored market intelligence gives buyers and sellers a way to:

orient themselves before making commitments

approach agents with better questions

price with confidence instead of hope

AI doesn’t fail at real estate because it lacks sophistication.

It fails because it hasn’t been given the right map.

Subdivisions are that map.

Comments