From Listings and Proximity to Context, Relationships, and Subdivision-Anchored Intelligence

The home-shopping experience isn’t being replaced — it’s evolving.

Buyers and homeowners no longer struggle to find information. Listings, prices, photos, and maps are everywhere. What’s increasingly difficult is understanding what actually matters.

In early 2026, the challenge in real estate is no longer access to data.

It’s interpreting relevance.

The Limits of Data Without Context

For years, real estate platforms have treated housing data as a collection of isolated facts:

a sale price without explaining why it sold there

a price-per-square-foot without clarifying what it’s compared to

a “home value” without defining the real competitive set

This leaves consumers with a difficult task:

deciding which data points actually deserve attention.

In many markets — especially condos — this approach breaks down entirely.

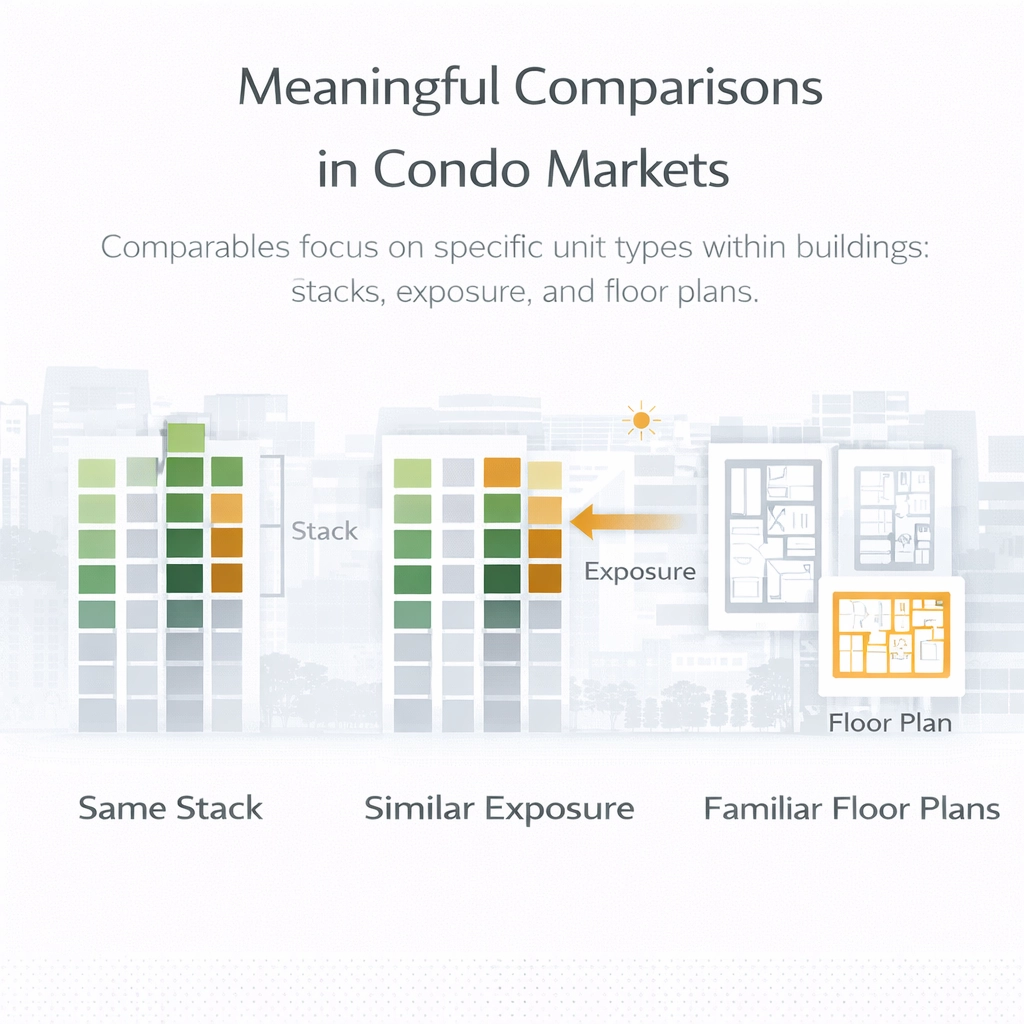

Why Condos Don’t Compete by Geography Alone

In condo markets, meaningful comparisons are made between specific unit types — often the same stack or line, similar exposure, and familiar floor plans.

In high-rise and mid-rise markets, value is shaped by factors that geography alone cannot capture:

the building or subdivision itself

unit stack or line

view and exposure

repeated layouts and floor plans

buyer behavior within that community

Two condos can share a ZIP code and still exist in completely different economic realities.

This is why experienced agents and appraisers rarely rely on proximity alone. They anchor their analysis to communities and buildings, because that’s where buyers actually compare options.

In vertical living markets, a simple truth applies:

For condos, the building is the market.

From Raw Listings to Market Relationships

What’s evolving in home shopping isn’t the amount of data available — it’s the way data is organized and explained.

Instead of asking:

“What is this home worth?”

Consumers increasingly want to know:

“What units do buyers actually cross-shop with this one?”

“How is this building behaving right now?”

“Is this price aligned with recent activity inside the same community?”

Answering those questions requires more than listings.

It requires relationships between data points, not just location.

The Role of AI: Interpretation, Not Prediction

AI’s real contribution to real estate isn’t guessing prices.

It’s interpretation.

When paired with structured, subdivision-level data, AI can:

distinguish meaningful comparables from background noise

explain price ranges without oversimplifying

translate market behavior into plain language

help users ask better questions before they make decisions

In this role, AI doesn’t replace professional judgment.

It makes market judgment accessible earlier in the process.

Why Structured Context Is a Prerequisite for Intelligent Systems

The future of home shopping is being built with AI in mind — whether the industry acknowledges it or not.

AI systems do not become intelligent because they process large volumes of unstructured data. They become intelligent when data is organized in a way that reflects how markets actually function.

In real estate, listings alone are not enough.

Transactions alone are not enough.

Proximity alone is not enough.

Without clearly defined communities, comparable relationships, and market boundaries, AI systems can only summarize patterns. They cannot explain them. They cannot distinguish signal from noise. And they cannot support real decision-making.

Subdivision-anchored data changes that.

By defining the community as the market — and modeling how buyers actually compare homes — structured micro-market data creates the foundation AI systems need to:

interpret pricing behavior rather than guess it

explain relevance rather than blend averages

surface meaningful context instead of generic outputs

In this sense, subdivision-level market intelligence isn’t just a better experience for today’s buyers and homeowners.

It’s a prerequisite for building the next generation of intelligent real estate tools.

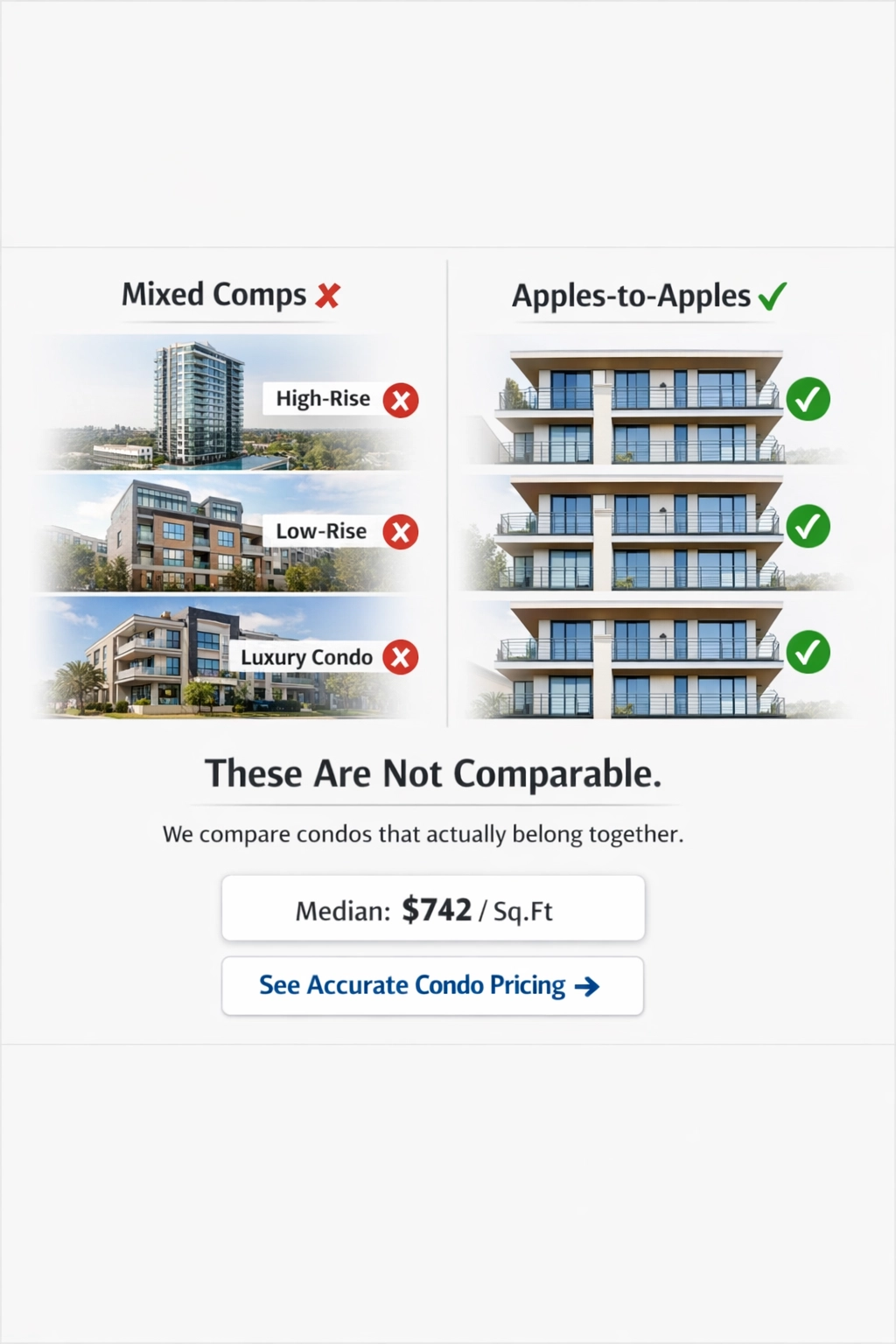

What Subdivision-Anchored Value Insights Enable

Subdivision-anchored analysis gives consumers something they historically haven’t had on their own:

apples-to-apples comparables inside the same community

clear visibility into building-level pricing and activity trends

context around why certain units command premiums or discounts

a credible starting point before speaking with a licensed professional

It doesn’t replace appraisals or professional CMAs.

It provides pre-decision clarity.

A More Transparent Decision-Making Experience

The future of home shopping isn’t about faster estimates or bigger maps.

It’s about:

clearer context

better data relationships

insights that explain why, not just what

Subdivision-anchored intelligence represents a shift toward market literacy — helping buyers and homeowners understand how value actually forms inside the communities they care about.

As real estate becomes more complex, that clarity isn’t optional.

It’s foundational.

About Subdivisions.com

Subdivisions.com is a Miami-based PropTech platform focused on subdivision- and building-level market intelligence. The platform helps buyers, homeowners, and professionals understand real estate value through apples-to-apples comparables, community-anchored trends, and AI-assisted explanations designed to make complex market behavior easier to interpret.

Comments